how to open hdfc bank account online? hdfc bank online account opening zero balance

HDFC bank is one of the largest banks in India. Its main thing is that it gives very good service to its customers. My account is already in HDFC bank and the good thing is that you can open online zero balance account in it from your mobile.

To know how to open zero balance hdfc bank account online, read this article completely.

Today I am going to tell you how you can open online zero balance account with HDFC Bank.

Zero balance means you do not have to do any amount maintenance.

In HDFC Bank, you will also get internet banking, debit card and check facility.

After opening the account, you will have to go to any branch within a year and do full kyc. After that you can do as many transactions as you want.

HDFC Zero Balance Account Features (hdfc bank account details)

Here are some of the features of a HDFC zero-balance Savings Account:

No Minimum Balance

Free passbook facility for all individual account holders

Enjoy free cash and check deposits at branches and ATMs.

Free email statement

Easy banking with features like NetBanking, MobileBanking which allows you to check your account balance, pay utility bills or even stop check payment through SMS.

To open an HDFC Bank zero balance account, you require

Identity and address proof such as valid passport, voter ID card, PAN card, permanent driving license, Aadhar card,

Latest passport size photographs

How to open a zero balance account with HDFC Bank?

Step #1. First of all, you have to go to the official website of HDFC Bank. And

Step #2. On your screen (the photo below will be displayed) page where you will enter your mobile number / Type the code shown (Case Sensitive) and type the text in the Enter code / Please read and confirm Privacy Policy box.

Tickmark and click the "Proceed" button. The OTP on your mobile will be entered and it will be verified.

Step #3. On your screen (the photo below will be shown), after this you have to choose a document for KYC, in which you can choose Aadhaar card, passport, voter card and driving license etc.

But if you choose Aadhaar, all the work will be done online.

In the second document, you will have to go to the bank, so we will select Aadhaar and enter the Aadhaar card number and proceed by clicking the "proceed" button. You have to accept the term.

Step #4. For this process it is necessary to have your mobile link with your Aadhaar card, now you have to verify the Aadhaar card for which you need an otp,

then you have to apply for otp and after putting otp, click the "proceed" button Proceed.

Step #5. On your screen (see photo below) here you have to choose the account type in which you have to choose a "savings account",

after this you have to choose "Basic Savings Bank Deposit Account" as this is the ZERO balance account. You will have to maintain an amount in the rest of your account, then proceed

Step #6. After this, you have to choose the branch in which you want to open an account. But keep in mind that the address which is in your Aadhar card,

you will have to choose the branch, in that only your account will open, in it the state and the district will already be there, you just have to enter the name of the local branch, like we have chosen here.

Step #7. On your screen (the photo below will be seen) after this, this page will appear in front of you, here you have to fill your photo and the remaining details,

along with that you have to enter your PAN card number and then upload the photo of the PAN card.

{These accounts will not open without PAN card.}

Step #8. On your screen (the photo below will be seen) after this you have to enter your full address here, in this you have to enter your permanent and malting address.

If the permanent and malting address are the same then both have to tick. The bank will send you your debit card and checkbook etc. to your address.

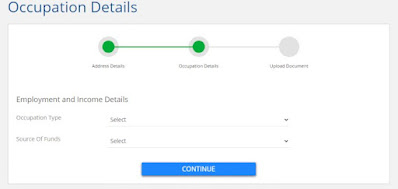

Step #9. After this, you have to enter your occupation details.

Occupation details mean what you do. Put any work you do in occupation details.

Step #10. Now here you have to choose whether you want to give Aadhaar card only for ID proof or for both ID and address.

Here, you have to choose the second option to give for both.

Step #11. Now after this, you have to make a nomination, in which you will have to fill the details of a person, in which you will fill the details of husband, wife, father and mother and

siblings and also enter their address, after your death, this is the same to your bank account. Will handle

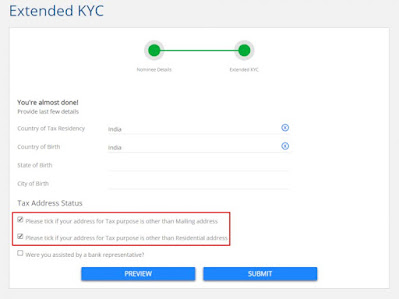

Step #12. After this, you have to fill in the details that in which country, in which state, in which district you were born and also to tick both in the tax address, after this, if you want to see the whole application, then click on the preview and If everything is correct, you will click on "Submit",

which will submit your form and your account number will also be generated immediately. Along with this, your bank will also have the IFSC code and your user ID as well so that you will log in to internet banking.

After this, your debit card will come by post to your address, which will take up to 15 days and the check book will also come, but you will get the passbook from the bank, along with this you will have to complete full kyc of this account in one year or else after one year It will stop You can go to any branch for full kyc.

Before full kyc, the limit of this account will also be only one lakh rupees, so when you get time, you have to get it full kyc. Along with this, you have to generate online internet banking password for which you have to go to this link

(https://netbanking.hdfcbank.com/netbanking/IpinResetUsingOTP.htm) and then proceed by entering your user id and then After this enter your mobile number. You will have otp on your mobile and email, you have to enter both otp and go ahead and set your password so that you can log in and manage your account.

Conclusion: If you have any kind of doubt about this article or have any suggestion to improve it, then do let us know by commenting.

Share this article with all your friends so that they can know how to open a zero balance account in HDFC Bank.